Form 1310 Statement of Person Claiming Refund Due a 2021

What is the Form 1310 Statement of Person Claiming Refund Due A

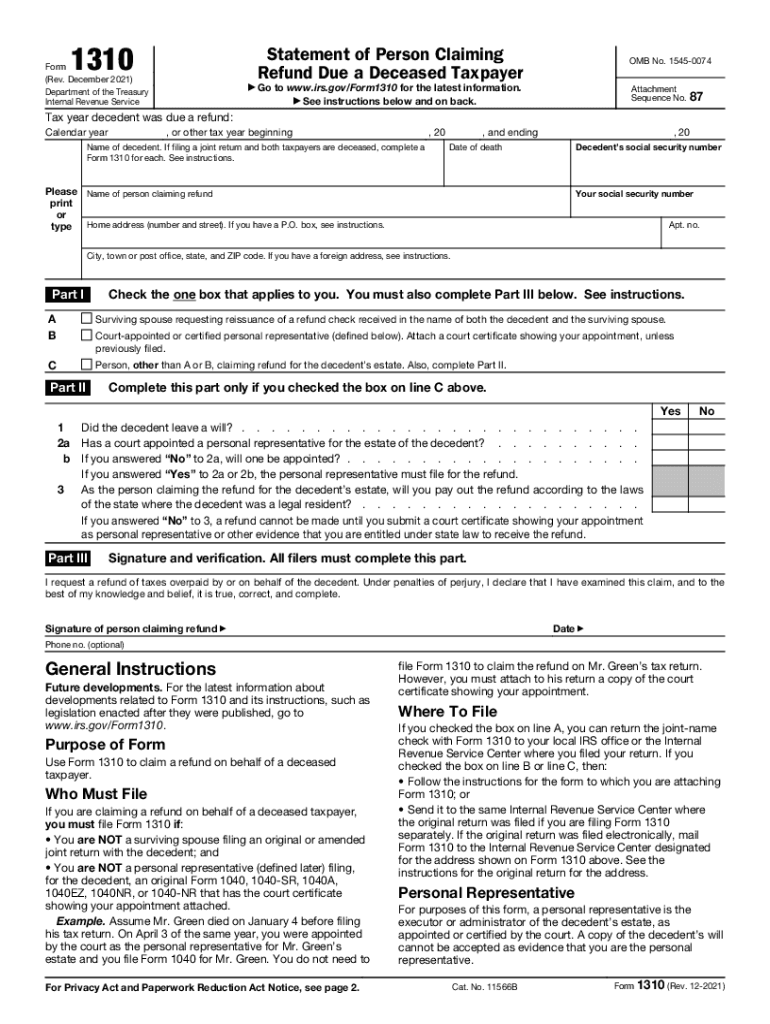

The Form 1310, also known as the Statement of Person Claiming Refund Due A, is a document used by individuals seeking a tax refund on behalf of a deceased taxpayer. This form is essential when the deceased individual has overpaid their taxes and the refund needs to be claimed by someone else, such as a family member or executor of the estate. It ensures that the rightful person receives the refund due to the deceased, complying with IRS regulations.

How to use the Form 1310 Statement of Person Claiming Refund Due A

To use the Form 1310 effectively, you need to complete it accurately and submit it along with the deceased taxpayer's final tax return. The form requires specific information about the deceased, including their Social Security number, and details about the claimant. It is crucial to ensure that all sections are filled out correctly to avoid delays in processing the refund. The completed form should be attached to the tax return when filed with the IRS.

Steps to complete the Form 1310 Statement of Person Claiming Refund Due A

Completing the Form 1310 involves several key steps:

- Gather necessary information about the deceased taxpayer, including their name, Social Security number, and details of the tax return.

- Fill out the claimant's information, ensuring accuracy in the name and contact details.

- Indicate the relationship to the deceased, which may affect eligibility to claim the refund.

- Sign and date the form, confirming that the information provided is accurate.

- Attach the completed Form 1310 to the final tax return of the deceased before submission to the IRS.

Legal use of the Form 1310 Statement of Person Claiming Refund Due A

The Form 1310 is legally recognized by the IRS for claiming tax refunds on behalf of deceased individuals. It ensures that the process adheres to tax laws and regulations, safeguarding the interests of both the claimant and the estate. Proper use of this form is essential to avoid legal complications and ensure that funds are distributed correctly according to tax laws.

Key elements of the Form 1310 Statement of Person Claiming Refund Due A

Key elements of the Form 1310 include:

- Decedent's Information: Full name, Social Security number, and date of death.

- Claimant's Information: Name, address, and relationship to the deceased.

- Signature: The claimant must sign the form to validate the request.

- Filing Details: Instructions on how to submit the form with the final tax return.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 1310. Typically, the final tax return for the deceased must be filed by the tax deadline of the year following their death. If a refund is expected, the Form 1310 should be submitted alongside this return to ensure timely processing. Missing these deadlines may result in delays or forfeiture of the refund.

Quick guide on how to complete form 1310 statement of person claiming refund due a

Prepare Form 1310 Statement Of Person Claiming Refund Due A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 1310 Statement Of Person Claiming Refund Due A on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to modify and electronically sign Form 1310 Statement Of Person Claiming Refund Due A with ease

- Find Form 1310 Statement Of Person Claiming Refund Due A and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign Form 1310 Statement Of Person Claiming Refund Due A and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1310 statement of person claiming refund due a

Create this form in 5 minutes!

How to create an eSignature for the form 1310 statement of person claiming refund due a

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the form 1310 IRS used for?

The form 1310 IRS is utilized to claim a refund on behalf of a deceased taxpayer. It allows the surviving spouse or executor to receive refunds that were due to the deceased. This form is crucial for ensuring that any overpaid taxes are returned.

-

How can airSlate SignNow help with form 1310 IRS submissions?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the form 1310 IRS. With our solution, users can simplify the process of completing and submitting important documents like the form 1310 IRS quickly and securely. Additionally, our features help track document history for peace of mind.

-

Are there any costs associated with using airSlate SignNow for form 1310 IRS?

Yes, airSlate SignNow offers competitive pricing plans that accommodate various business needs for submitting forms like the form 1310 IRS. We provide a cost-effective solution tailored for users who want to streamline document management and eSigning processes. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers various features such as eSignature, document templates, and real-time collaboration. These features enhance the signing experience and make it effortless to process forms like the form 1310 IRS. Users also benefit from secure cloud storage and multi-party signing options.

-

Can airSlate SignNow integrate with other tools for managing form 1310 IRS?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications. This integration capability allows users to streamline workflows that involve the form 1310 IRS and ensure that all documents are processed efficiently within their existing ecosystem.

-

Is airSlate SignNow compliant with IRS regulations for form 1310 IRS?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your submissions, including the form 1310 IRS, are secure and legally valid. Our platform follows industry standards for electronic signatures, helping users feel confident in their document submissions.

-

What are the benefits of using airSlate SignNow for form 1310 IRS?

Using airSlate SignNow for form 1310 IRS allows for faster processing and enhanced security of sensitive documents. Benefits include easy access from any device, reduced paperwork hassles, and a clear audit trail for submitted forms. Our user-friendly interface also ensures that even individuals unfamiliar with eSigning can navigate the process easily.

Get more for Form 1310 Statement Of Person Claiming Refund Due A

- Legal last will and testament form for married person with adult children georgia

- Will with no children form

- Ga last will form

- Codicil will your form

- Ga wills 497304195 form

- Mutual wills package with last wills and testaments for married couple with no children georgia form

- Mutual wills package with last wills and testaments for married couple with minor children georgia form

- Legal last will and testament form for married person with adult and minor children from prior marriage georgia

Find out other Form 1310 Statement Of Person Claiming Refund Due A

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation